Trend Following in Binary Options: A Simple Strategy for Stable Wins in Trending Markets

Trend Following in Binary Options: A Simple Strategy for Stable Wins in Trending Markets

Trend Following in Binary Options: A Simple Strategy for Stable Wins in Trending Markets

Trend-following is one of the oldest and most robust ideas in financial markets. While many strategies depend on precise timing or complex indicators, trend-following is based on a simple premise: prices tend to continue moving in the same direction longer than most traders expect. In binary options, this logic becomes even more powerful due to fixed risk and predefined outcomes.!Trend-following in binary options focuses on trading in the direction of established market movement, using short- to medium-term expirations to capture continuation rather than reversals. This approach reduces decision complexity and increases statistical stability in trending conditions.

Why Trend-Following Fits Binary Options Naturally

Binary options are not designed for catching tops and bottoms. They reward directional accuracy, not magnitude. Trend-following aligns perfectly with this structure because it removes the need to predict exact turning points.In trending markets, probability is asymmetrical. When price consistently forms higher highs and higher lows, buying in the direction of the trend requires less precision than countertrend trading. The trader is not asking when the trend will end, only whether it is still active during the option’s expiration window.

This logic mirrors how professional trend-following funds operate across futures and FX markets: they enter late, exit late, and accept that missing reversals is the cost of consistency.

Trend Following in Binary Options: A Simple Strategy for Stable Wins in Trending Markets

Defining a Trend in Practical Terms

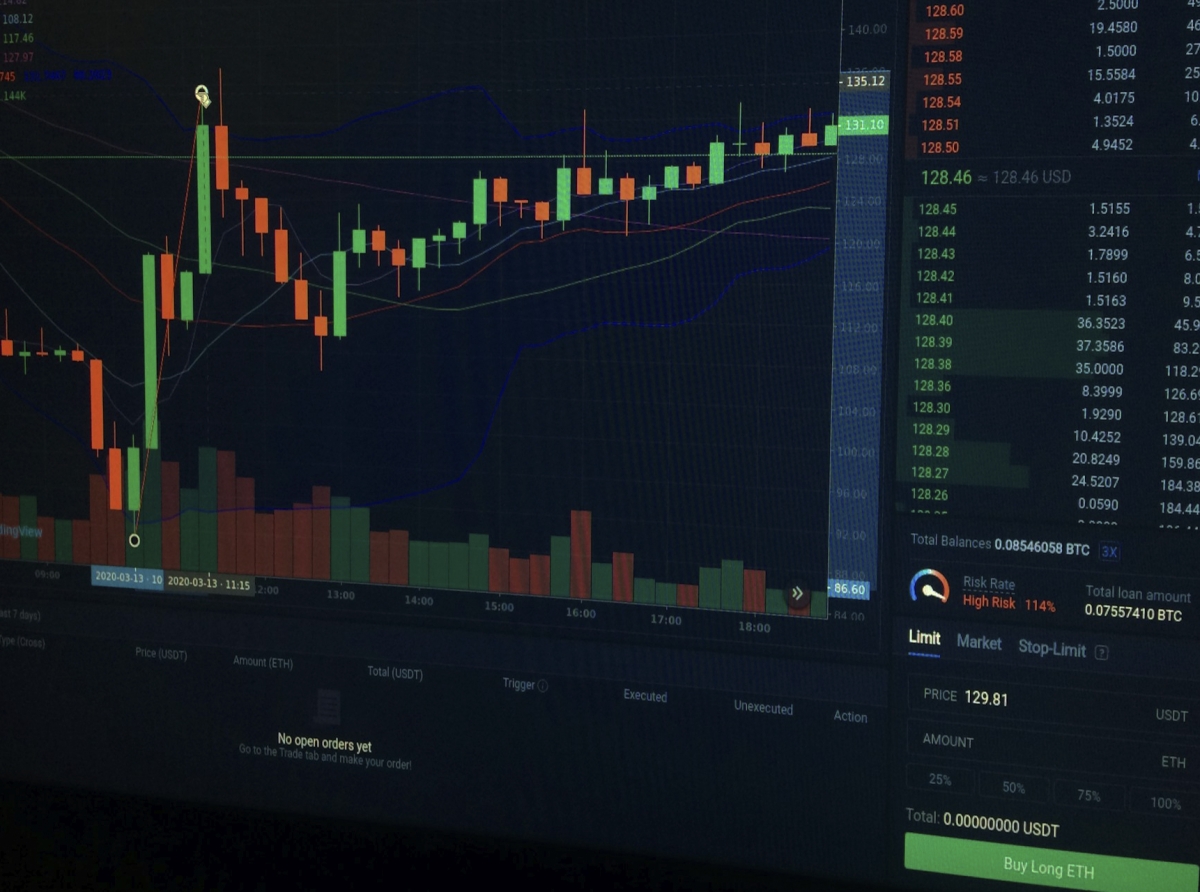

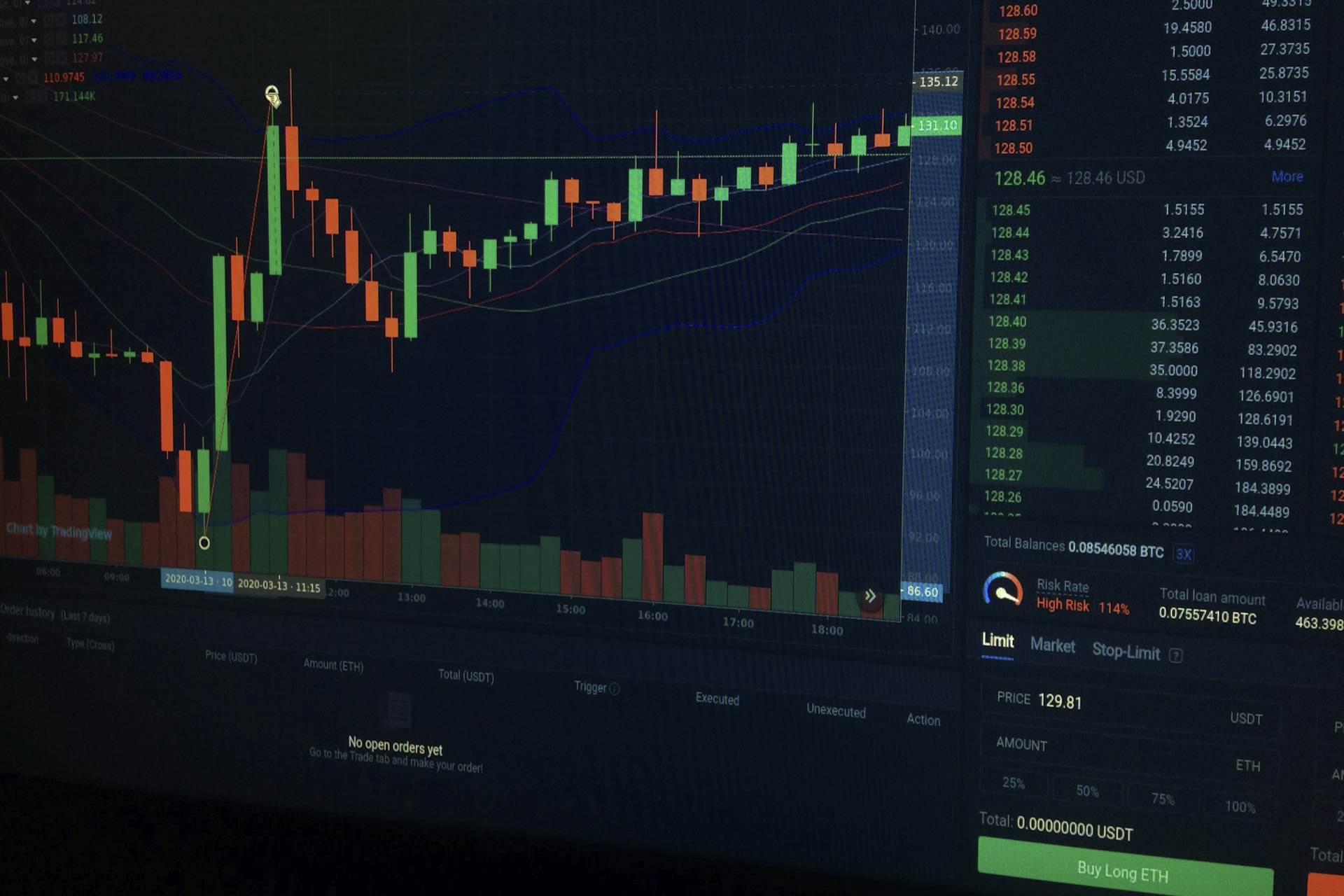

A trend is not a feeling or a diagonal line drawn after the fact. In operational terms, a trend exists when price shows directional structure and momentum over a defined timeframe.In binary options, trends are most reliable when confirmed on higher timeframes and executed on lower ones. For example, a trend identified on the 15-minute or 30-minute chart provides directional bias, while entries are made on the 1-minute or 5-minute chart with short expirations.

This multi-timeframe alignment reduces noise and filters out random price fluctuations that dominate flat markets.

Why Trend Markets Produce More Stable Results

Most traders lose money not because their strategies fail, but because they apply them in the wrong market conditions. Trend-following performs poorly in ranges, but excels when volatility is directional.Trending markets offer:

cleaner price structure

fewer false signals

higher probability of continuation

In such conditions, even a simple trend-following setup can outperform more complex strategies. The edge does not come from indicators — it comes from market state selection.

Execution Logic in Binary Options

In binary options, trend-following is about synchronization, not prediction. The trader waits for minor pullbacks or consolidations within the trend and enters in the direction of the dominant move.Short expirations, such as 1-minute or 3-minute options, are often used to exploit micro-continuations, while longer expirations fit intraday trends during active sessions.

Because risk and reward are fixed, the trader can focus entirely on directional correctness, removing the emotional burden of managing exits.

Risk Management and Probability Distribution

Trend-following does not win every trade. Its strength lies in probability clustering. In trending markets, sequences of wins often appear because continuation dominates reversal.

Binary options amplify this effect by:

capping downside on each attempt

standardizing risk per trade

allowing repetition without exposure drift

This structure allows traders to survive drawdowns and benefit from streaks without increasing position size emotionally.

Geographic and Session Context

Trend-following in binary options works best during periods of sustained liquidity. In Forex markets, this typically includes the London and New York sessions, where directional moves are more likely.US macro releases, ECB policy cycles in the EU, and sustained risk-on or risk-off sentiment in global markets often create conditions where trends persist long enough to be exploited with short expirations.

The strategy is global in nature, but timing remains critical.

Outlook for 2025–2026

As markets remain sensitive to monetary policy shifts and geopolitical uncertainty, directional moves are likely to remain a defining feature of Forex and index markets. Trend-following strategies, especially those that avoid over-optimization, are well-positioned for such environments.Binary options offer a simplified framework for expressing this timeless concept without the complexities of stop losses, leverage, and open-ended exposure.

Trend-following in binary options is not about innovation. It is about alignment. When market structure, direction, and timing converge, even a simple strategy can deliver stable results.

The advantage lies not in predicting reversals, but in accepting continuation — and letting probability do the work.

The advantage lies not in predicting reversals, but in accepting continuation — and letting probability do the work.

Written by Ethan Blake

Independent researcher, fintech consultant, and market analyst.

January 08, 2026

Join us. Our Telegram: @forexturnkey

All to the point, no ads. A channel that doesn't tire you out, but pumps you up.

Independent researcher, fintech consultant, and market analyst.

January 08, 2026

Join us. Our Telegram: @forexturnkey

All to the point, no ads. A channel that doesn't tire you out, but pumps you up.

Report

My comments