Liquidity bridge vs liquidity aggregator explained. How brokers use MT4/MT5 bridges, aggregation, routing logic, and risk control to ensure stable execution as volumes scale.

All Stories

Indonesia Market Shock: IDX CEO Resigns After $84 Billion Market Collapse Triggered by MSCI Downgrade Fears

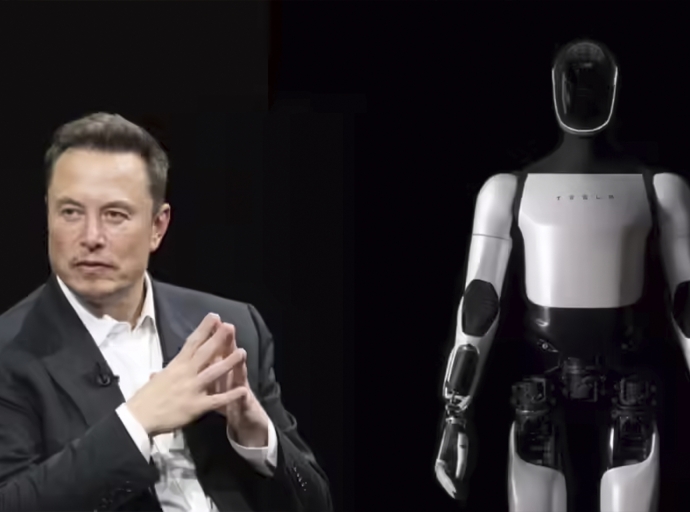

Tesla is ending the era of the Model S and X and making a strategic pivot to Optimus robots. What does this mean for the company's business, the labor market, and the technology race?

How Turnkey Brokerage Solutions help new brokers launch, scale, and survive in a competitive forex market through full-cycle technical, legal, and business support.

How institutional hedge funds use MAM systems to scale Forex execution, control risk across multiple strategies, and why this infrastructure decision directly impacts performance stability.

Team Psychology in Trading: How Communities, Social Trading, and Experience Sharing Enhance Resilience, Discipline, and Long-Term Performance in Traders

In an era of global economic uncertainty, trade agreements are becoming a key tool for driving growth. One of the most anticipated developments in 2026 is the partnership between the European Union (EU) and India—a deal that could radically transform several high-revenue industries. From luxury goods to aviation, these sectors have all the chances to become the main beneficiaries of this new partnership.

Forex trading develops the skill of accepting uncertainty more effectively than psychotherapy. Learn how working with probabilities changes your thinking and the psychology of your life decisions.

The U.S. dollar enters a bearish phase as capital flows shift globally. Why dollar weakness helps exports but signals deeper structural risks for the U.S. economy.

Global trade is changing after 2025. Discover which currencies win and lose from tariffs, reshoring, and supply chain shifts.