How to Identify Them and Overcome Their Impact

How to Identify Them and Overcome Their Impact

In the fast-paced world of trading, every millisecond counts. Traders are always on the lookout for factors that could potentially affect their trades negatively. One such factor that often poses a significant challenge is the phenomenon of requotes. Requotes occur when a broker is unable to execute a trade at the price requested by the trader and offers a new price instead. This can be particularly frustrating for traders, as it disrupts their strategies and can lead to financial losses. Addressing requotes is crucial for maintaining trading efficiency and profitability.

How to Identify Them and Overcome Their Impact

Causes of Requotes

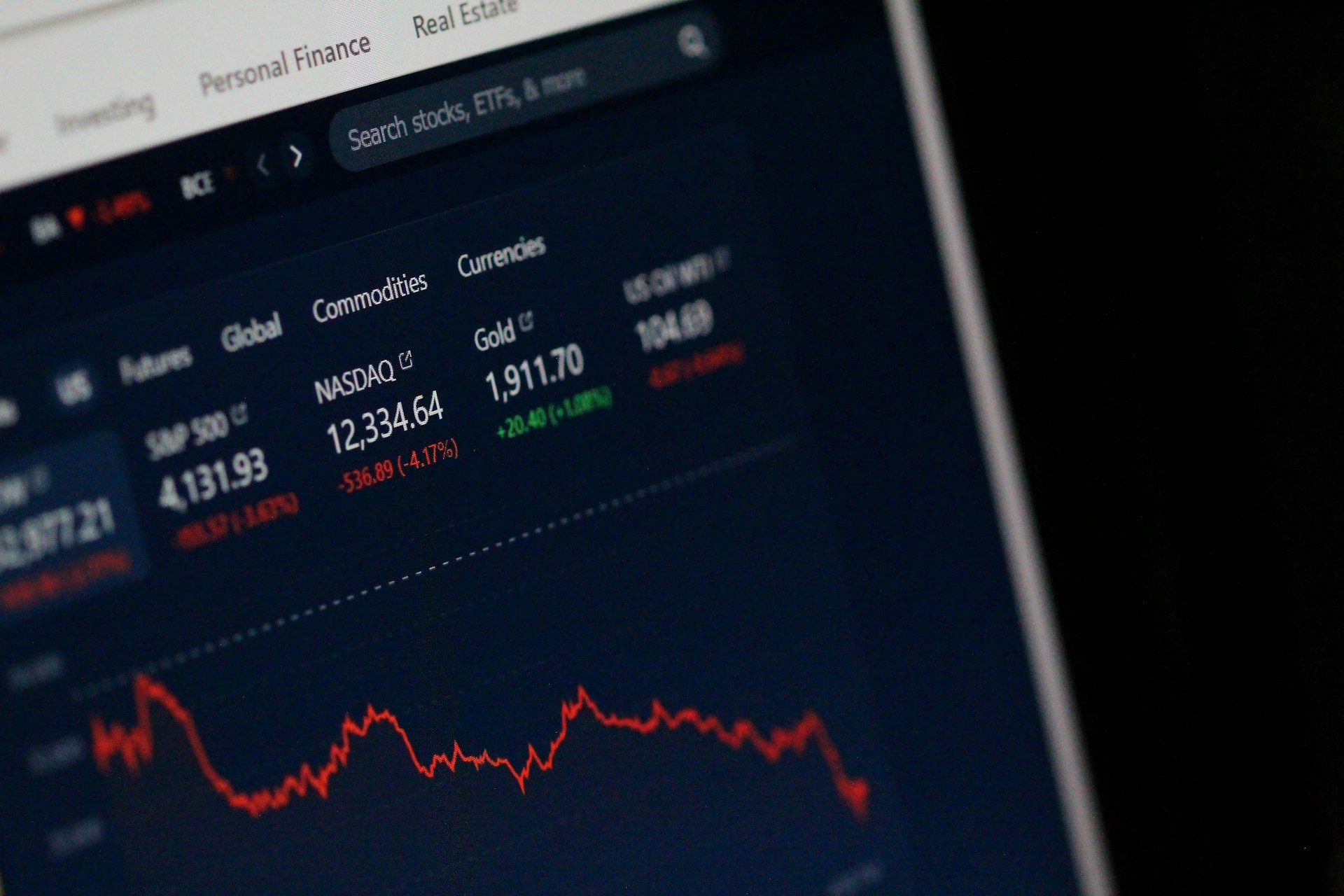

Market VolatilityOne of the primary causes of requotes is market volatility. Financial markets can experience rapid price changes, especially during periods of high activity or economic announcements. When prices fluctuate significantly within a short span, brokers might struggle to match the requested price with the current market conditions, leading to requotes.

Latency Issues

Latency refers to the delay between when an order is placed and when it is executed. In an ideal world, this delay would be negligible. However, various factors such as internet speed, server performance, and geographical distance between the trader and broker can introduce latency. This delay means that by the time an order reaches the broker’s server, market prices might have already changed, resulting in a requote.

Broker Practices

Not all brokers operate with the same level of transparency and efficiency. Some brokers may have policies or practices that contribute to higher instances of requotes. For example, brokers with slower execution speeds or those who intentionally manipulate prices may cause more frequent requotes. Understanding your broker’s practices is essential in mitigating this issue.

Identifying Requotes

Signs and Indicators of RequotesIdentifying when a requote has occurred is essential for traders to adapt their strategies accordingly. Common signs include receiving notifications from your trading platform indicating a change in price or frequent disruptions during high-frequency trading sessions.

Tools and Techniques for Detection

Several tools can help traders detect requotes more effectively. For instance, advanced trading platforms often come equipped with features that highlight instances where a trade was not executed at the requested price. Additionally, third-party software can monitor trade execution times and compare them against market prices to flag potential requotes.

Impact of Requotes on Trading

Financial ConsequencesThe most immediate impact of requotes is financial loss. When a trade isn’t executed at the desired price, it can result in missed opportunities or unfavorable entry points. Over time, these small discrepancies can accumulate into significant financial drawbacks for traders who rely on precise execution.

Effect on Trader Psychology and Decision-Making

Requotes don’t just affect financial outcomes; they also take a toll on trader psychology. Consistent disruptions can lead to frustration and erode confidence in one’s trading strategy or broker reliability. This psychological strain can result in impulsive decisions or overly cautious behavior, neither of which are conducive to successful trading.

Strategies to Overcome Requotes

Choosing the Right BrokerSelecting a reliable broker with low latency and transparent practices is fundamental in minimizing requotes. Look for brokers known for their fast execution times, robust infrastructure, and positive user reviews regarding trade execution reliability.

Utilizing Technology for Faster Execution

Leveraging technology such as Virtual Private Servers (VPS) close to your broker’s servers can significantly reduce latency issues. Additionally, using direct market access (DMA) platforms ensures that your orders are sent directly to exchanges without intermediary delays.

Developing Adaptive Trading Strategies

Traders must develop strategies that account for potential market volatility and requotes. This might include setting wider stop-loss limits during high-volatility periods or using limit orders instead of market orders to control entry prices more effectively.

Requotes present a notable challenge in the trading landscape but are not insurmountable obstacles. By understanding their causes—market volatility, latency issues, and broker practices—traders can better identify instances when they occur through signs and detection tools. The impact on both financial outcomes and psychological well-being underscores the importance of addressing this issue head-on.

By choosing reliable brokers, leveraging advanced technology for faster trade execution, and developing adaptive strategies tailored to volatile markets, traders can mitigate the adverse effects of requotes effectively. In doing so, they not only protect their financial interests but also maintain confidence in their trading activities amidst ever-changing market conditions.

Requotes, Trading, Financial Markets, Volatility, Broker Practices

By choosing reliable brokers, leveraging advanced technology for faster trade execution, and developing adaptive strategies tailored to volatile markets, traders can mitigate the adverse effects of requotes effectively. In doing so, they not only protect their financial interests but also maintain confidence in their trading activities amidst ever-changing market conditions.

Requotes, Trading, Financial Markets, Volatility, Broker Practices

Report

My comments