Mastering Forex Trading: Strategies for Achieving Stable Income

Mastering Forex Trading: Strategies for Achieving Stable Income

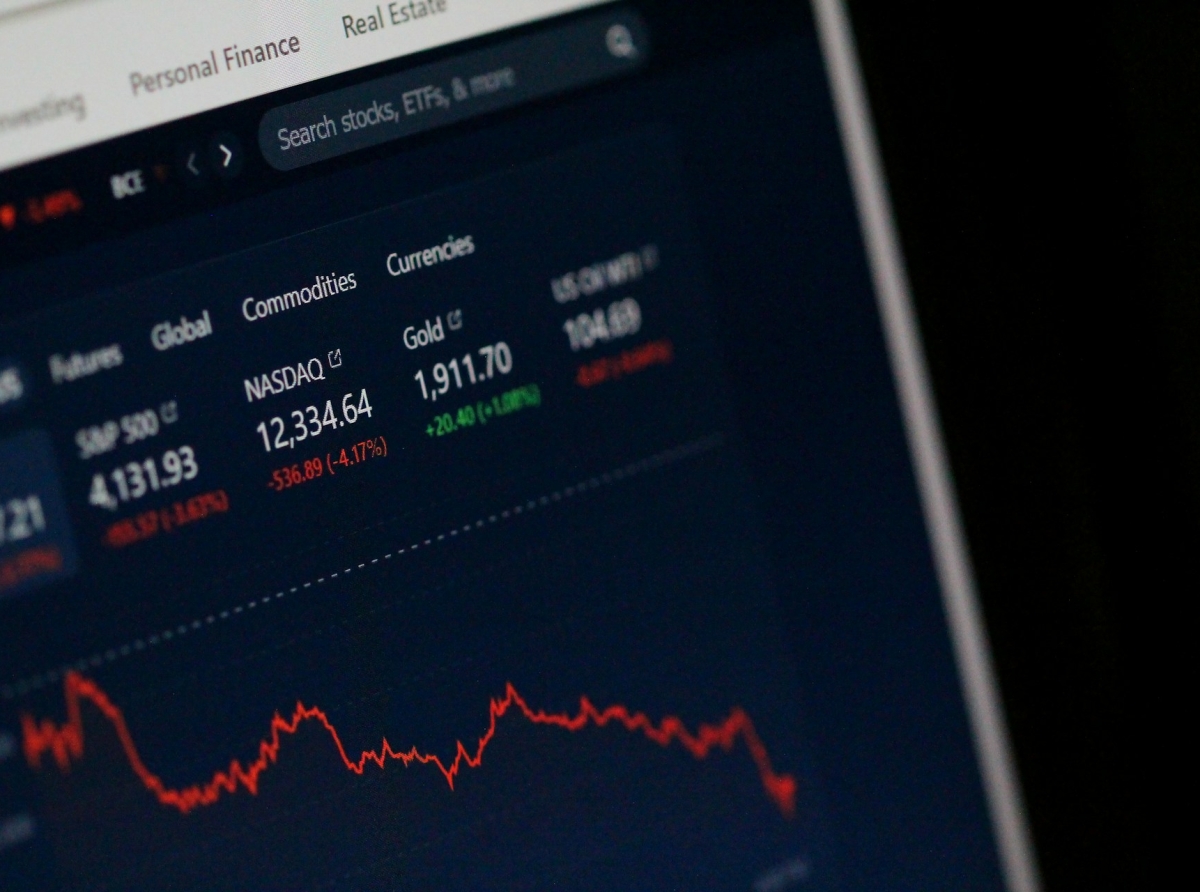

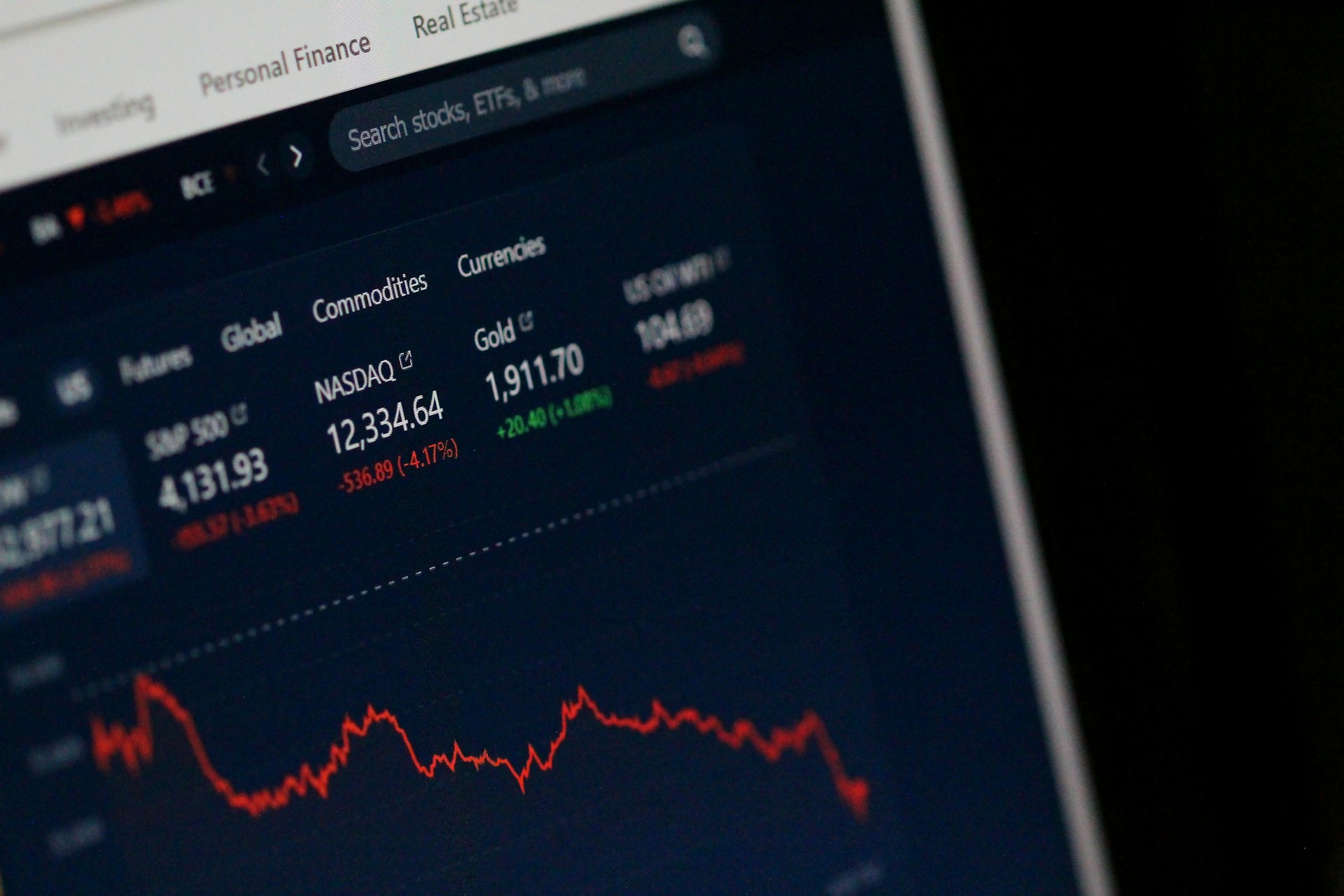

Forex trading, also known as foreign exchange trading, involves buying and selling currencies with the aim of making a profit. The Forex market is the largest financial market globally, with a daily turnover exceeding $6 trillion. This vast market operates 24 hours a day, five days a week, allowing traders from all over the world to participate.

Mastering Forex trading is crucial for those who wish to achieve stable income through this market. Unlike stock markets that have limited operating hours, the Forex market offers continuous opportunities due to its global nature. Understanding the intricacies of this market provides traders with significant advantages and potential financial rewards.

Mastering Forex trading is crucial for those who wish to achieve stable income through this market. Unlike stock markets that have limited operating hours, the Forex market offers continuous opportunities due to its global nature. Understanding the intricacies of this market provides traders with significant advantages and potential financial rewards.

Mastering Forex Trading: Strategies for Achieving Stable Income

Fundamental Analysis in Forex

Fundamental analysis in Forex involves evaluating various economic indicators and political events that can impact currency values. Key economic indicators include:Gross Domestic Product (GDP): Reflects the overall economic health of a country.

Employment Data: Indicators like non-farm payrolls in the US can significantly impact currency values.

Inflation Rates: Central banks’ monetary policies are often influenced by inflation trends.

Interest Rates: Higher interest rates generally attract more foreign capital investment.

Political events also play a crucial role in currency fluctuations. Elections, geopolitical tensions, and policy changes can lead to significant volatility in the Forex market. For instance, Brexit had substantial effects on the British Pound (GBP), showcasing how political developments can drive currency movements.

Technical Analysis Techniques

Technical analysis focuses on historical price data and chart patterns to predict future price movements. Key techniques include:Chart Patterns: Patterns like head and shoulders, double tops/bottoms, and triangles can signal potential reversals or continuation of trends.

Technical Indicators: Moving averages, Relative Strength Index (RSI), and Bollinger Bands are commonly used to identify entry and exit points.

Historical data plays a vital role in technical analysis. By studying past price movements and patterns, traders can make informed predictions about future trends. For example, if a currency pair has shown consistent behavior when reaching certain price levels or during specific times of the year, traders can use this information to their advantage.

Risk Management Strategies

Effective risk management is essential for achieving stable income in Forex trading. Key strategies include:Setting Stop-Loss Orders: These orders automatically close a trade at a predetermined price level to limit losses.

Diversification: Spreading investments across different currency pairs reduces risk exposure.

Managing Leverage: While leverage allows traders to control larger positions with smaller capital, it also amplifies potential losses. Proper leverage management is crucial.

These strategies help protect capital and ensure that one bad trade does not wipe out previous gains. Consistent implementation of risk management techniques is critical for long-term success.

Developing a Consistent Trading Plan

A consistent trading plan is vital for achieving stability in Forex trading. This plan should include:Discipline and Patience: Adhering strictly to your trading plan without being swayed by emotions or short-term market movements.

Continuous Learning: The Forex market is dynamic; staying updated with new strategies, tools, and global events is crucial.

Developing a plan involves setting clear goals, defining risk tolerance levels, selecting appropriate trading strategies, and regularly reviewing performance. Discipline ensures that traders stick to their plan even during volatile periods while continuous learning allows them to adapt to changing market conditions.

Achieving stable income through Forex trading requires mastering both fundamental and technical analysis while employing robust risk management strategies. A disciplined approach coupled with continuous learning leads to consistent success in this dynamic market. By understanding key economic indicators, analyzing historical data, managing risks effectively, and developing a solid trading plan—traders can navigate the complexities of the Forex market confidently and achieve their financial goals.

Forex trading, Stable income, Risk management, Fundamental analysis, Technical analysis

Forex trading, Stable income, Risk management, Fundamental analysis, Technical analysis

Report

My comments