Night Trading on Forex: Features, Benefits, and Strategies

Night Trading on Forex: Features, Benefits, and Strategies

Night trading on Forex offers unique opportunities for traders who prefer calmer markets and strategic setups. While daytime sessions, especially in the US and Europe, bring high volatility, the Asian night session provides slower, more predictable price movements.

This environment can benefit swing traders, beginners, and those seeking to refine their strategies without constant stress. By leveraging time-zone differences, applying specific strategies like range trading or breakout anticipation, and focusing on liquidity during the Tokyo session, night trading transforms into a practical and profitable approach for many.

This environment can benefit swing traders, beginners, and those seeking to refine their strategies without constant stress. By leveraging time-zone differences, applying specific strategies like range trading or breakout anticipation, and focusing on liquidity during the Tokyo session, night trading transforms into a practical and profitable approach for many.

What Is Night Trading in Forex?

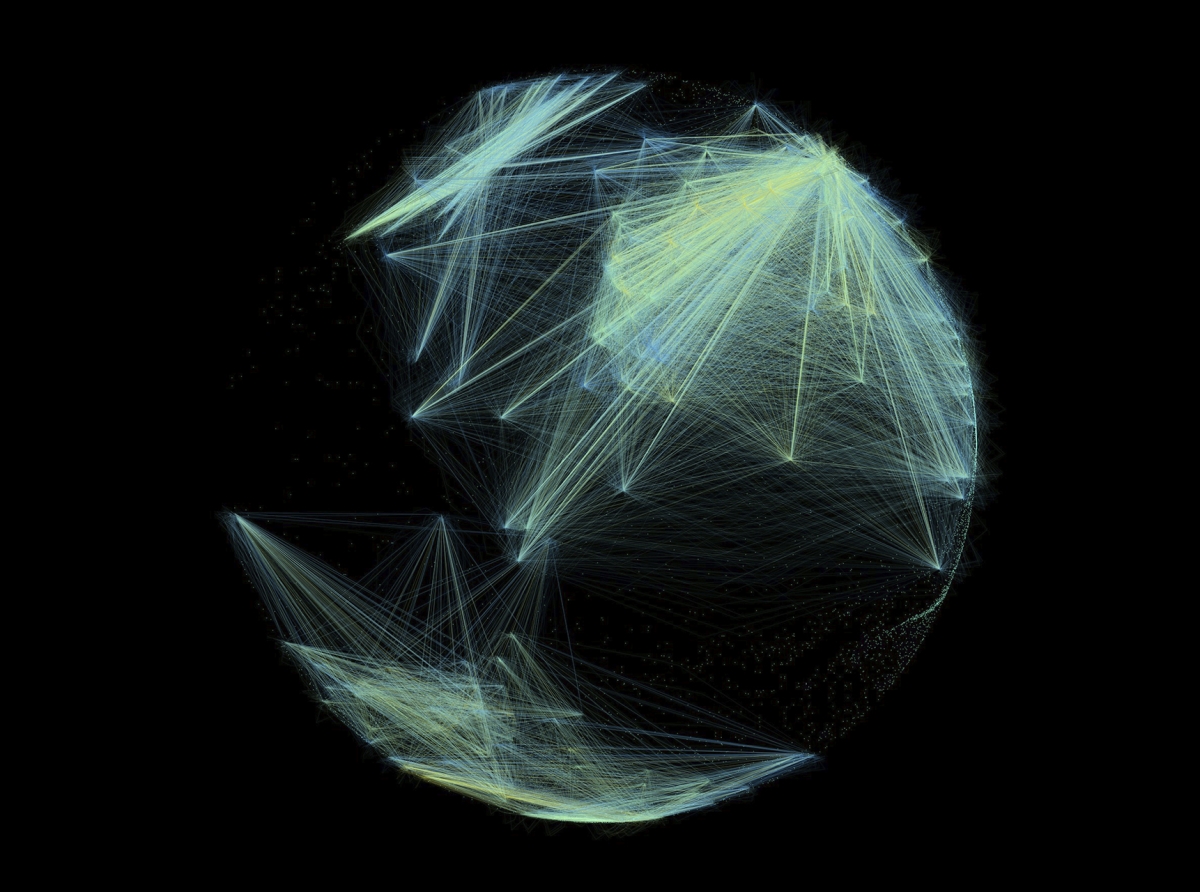

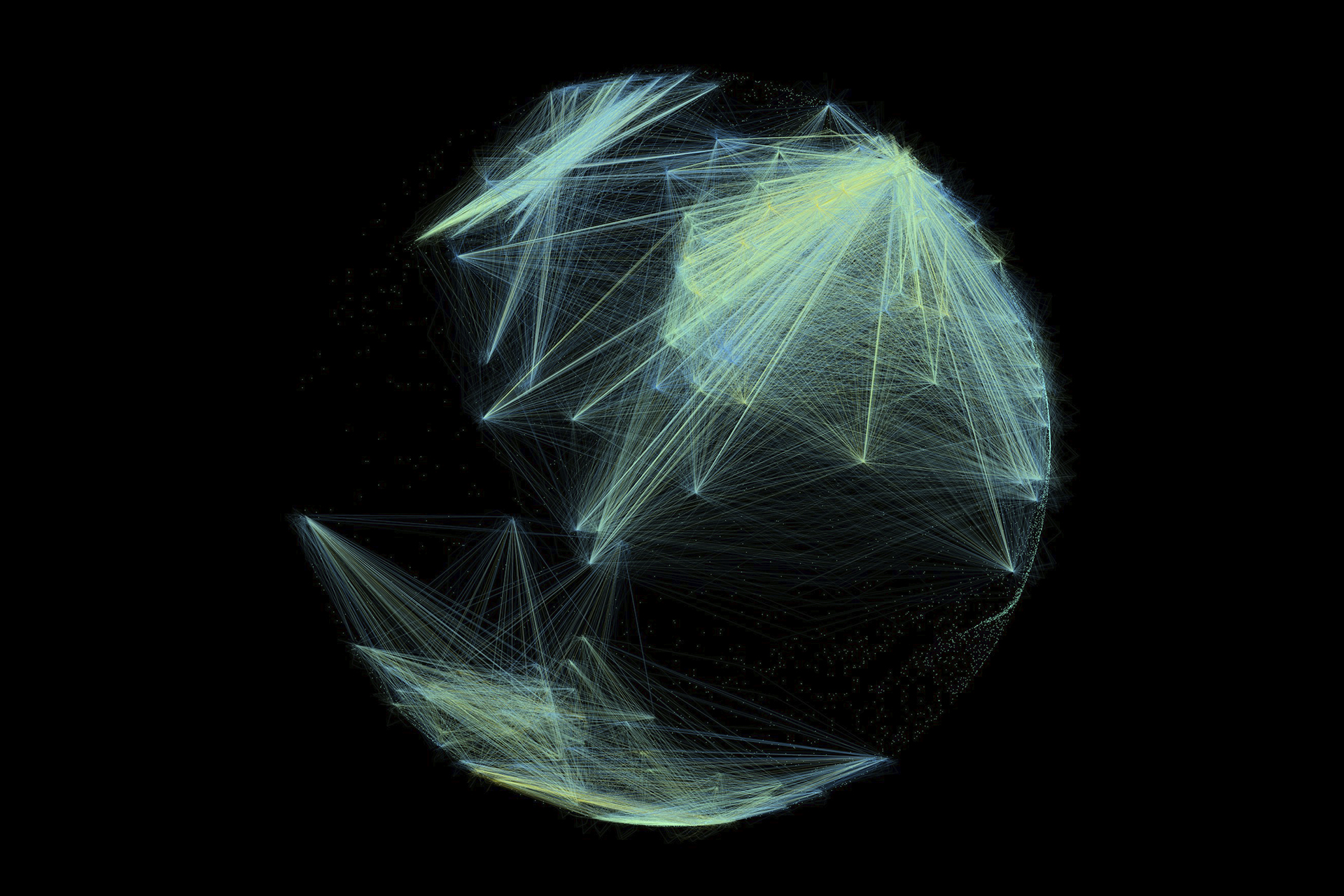

Night trading refers to trading during lower-activity market hours, typically between the New York close and the Asian (Tokyo) session. For traders in the US and Europe, this usually means trading late evening to early morning. Liquidity is lower, volatility decreases, and spreads may widen slightly compared to the London or New York sessions.Despite this, many traders prefer nighttime hours because the calmer pace allows for more structured decision-making. Instead of reacting to every sharp move, traders can study patterns and focus on technical setups.

Night Trading on Forex: Features, Benefits, and Strategies

Why Night Trading Matters for Different Regions

United States: Night trading coincides with post-New York close. Many American traders use this time for preparation, placing pending orders, or catching trends in USD/JPY and AUD/USD.Europe: For European traders, late-night hours align with the Asian session. This provides exposure to yen-related pairs and commodities tied to Asian economies.

Asia: The Tokyo session itself is considered the prime “night market,” with liquidity driven by Japanese institutions, Bank of Japan interventions, and Asian corporate flows.

According to the Bank for International Settlements (BIS), the Japanese yen accounts for around 17% of daily FX turnover (2024). This makes the night session highly relevant despite overall lower volumes compared to London or New York.

Advantages of Night Trading

Lower Volatility, Clearer Patterns – Price movements are less chaotic, allowing traders to refine strategies.Focus on Asian Pairs – Currency pairs like USD/JPY, AUD/JPY, and NZD/USD often show stable patterns at night.

Less Competition – Fewer active traders reduce “noise,” giving patient traders a chance to plan entries.

Lifestyle Flexibility – Night trading fits the schedules of part-time traders in the US or Europe who have day jobs.

For example, a trader in London may find the Tokyo session ideal for scalping EUR/JPY, while a US-based trader can analyze AUD/USD as Asia opens.

Key Strategies for Night Trading on Forex

1. Range TradingSince the market often consolidates during night hours, range trading between support and resistance zones becomes highly effective.

2. Breakout Preparation

Although volatility is lower, night trading often sets the stage for breakouts during the London open. Traders can position themselves early with stop orders above/below key levels.

3. Yen-Focused Pairs

The Tokyo session is dominated by yen flows. USD/JPY and cross-pairs like GBP/JPY often move in response to Japanese economic data or Bank of Japan (BOJ) policy signals.

4. Carry Trade Monitoring

Night trading is also ideal for monitoring interest-rate differentials (e.g., AUD/JPY carry trades), especially when Asian markets react to commodity prices.

Real Examples of Night Trading Cases

In Japan (Tokyo session Q2 2025), the USD/JPY held a tight 30-pip range before breaking upward as European traders joined. A Singapore-based trader used a pending breakout order and captured 40 pips at low risk.In the US, traders working after hours have been using the night session to place orders on AUD/USD, aligning with commodity moves from Australia’s export market.

In Europe, German traders often leverage the calm Asian session to analyze EUR/USD technicals without interference from ECB press releases or US data noise.

Analytical Outlook and Forecast for Night Trading (2025–2027)

Short-term (2025–2026): Night trading will grow in popularity among part-time traders, especially in the US and Europe, as remote work culture continues to expand.Mid-term (2026–2027): With AI-powered trading bots and algorithmic tools, night session strategies will become more automated. Brokers in Asia will see increased trading activity, particularly in Singapore and Hong Kong, as fintech platforms expand.

Liquidity is unlikely to rival the London or New York sessions, but stable growth in Asia-Pacific trading volumes will continue to make night trading a niche yet reliable strategy.

Conclusion

Night trading on Forex is not just an alternative for those who can’t trade during the day — it’s a distinct strategy with its own rules and advantages.

By focusing on calmer markets, yen-related pairs, and range or breakout setups, traders can turn the “quiet hours” into profitable opportunities. With growing participation from Asia and a rise in global retail trading, the future of night trading looks promising for both beginners and professionals.

By Jake Sullivan

September 17, 2025

Join us. Our Telegram: @forexturnkey

All to the point, no ads. A channel that doesn't tire you out, but pumps you up.

Night trading on Forex is not just an alternative for those who can’t trade during the day — it’s a distinct strategy with its own rules and advantages.

By focusing on calmer markets, yen-related pairs, and range or breakout setups, traders can turn the “quiet hours” into profitable opportunities. With growing participation from Asia and a rise in global retail trading, the future of night trading looks promising for both beginners and professionals.

By Jake Sullivan

September 17, 2025

Join us. Our Telegram: @forexturnkey

All to the point, no ads. A channel that doesn't tire you out, but pumps you up.

Report

My comments