Understanding Slippage in Trading: Causes, Impact, and Prevention Strategies

Understanding Slippage in Trading: Causes, Impact, and Prevention Strategies

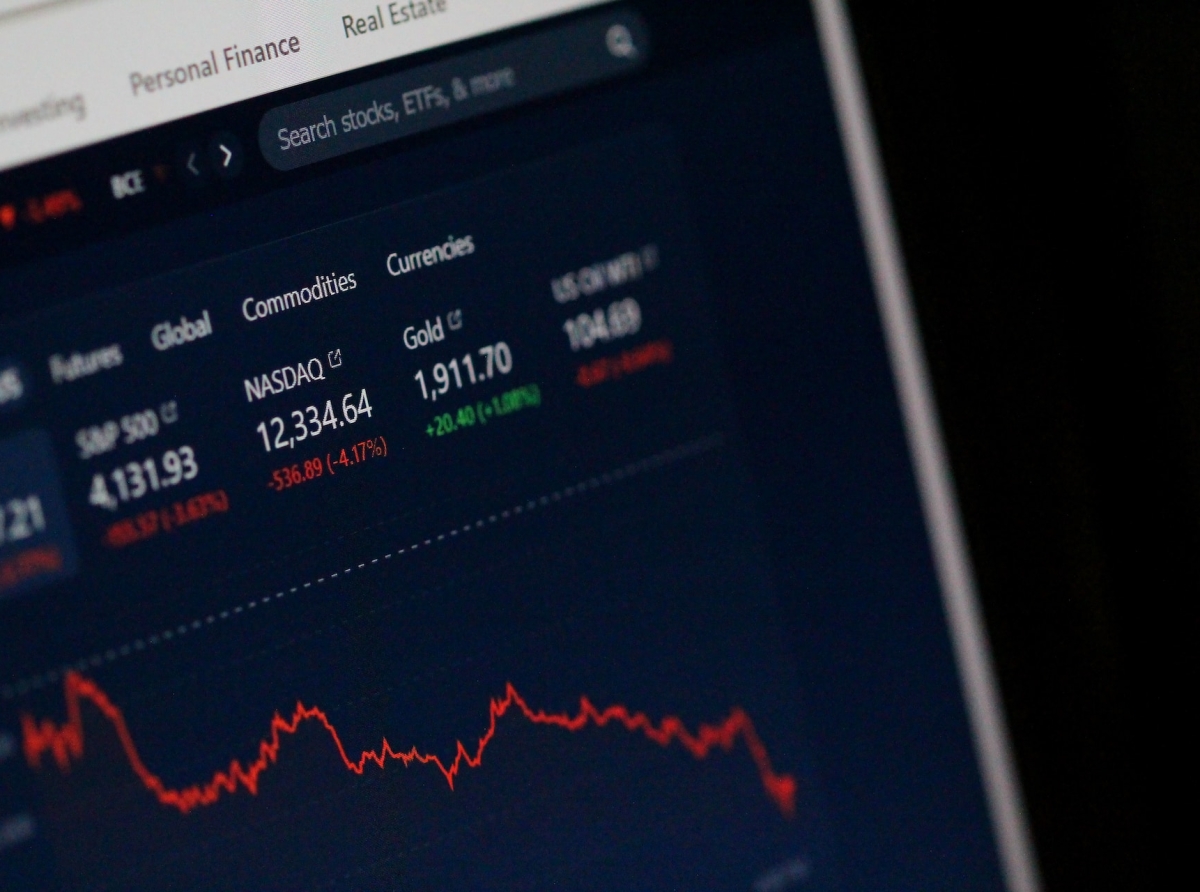

In the intricate dance of financial markets, slippage represents an often uninvited but inevitable step. It is a concept familiar to anyone who has dipped their toes into the world of trading, whether dealing in stocks, forex, commodities, or any other tradable asset. Slippage occurs when there is a difference between the expected price of a trade and the price at which the trade is actually executed.

This discrepancy arises from the ever-changing environment of financial markets; prices fluctuate constantly due to supply and demand dynamics. When an order is placed, there can be a lag between the time of request and the moment it’s filled. During this window, market prices can shift away from the initial quote - this movement is what we know as ‘slippage’.

This discrepancy arises from the ever-changing environment of financial markets; prices fluctuate constantly due to supply and demand dynamics. When an order is placed, there can be a lag between the time of request and the moment it’s filled. During this window, market prices can shift away from the initial quote - this movement is what we know as ‘slippage’.

Understanding Slippage in Trading: Causes, Impact, and Prevention Strategies

Causes of Slippage: Market Conditions and Execution Delays

Several factors contribute to slippage; let’s unpack them:Market Volatility: When markets are turbulent, prices can change rapidly and significantly. This volatility means that orders are more likely to experience slippage as they catch up with swift price movements.

Liquidity: A highly liquid market with many buyers and sellers typically has less slippage due to easier order fulfillment. Conversely, in markets where liquidity is thin, orders may not be filled immediately, leading to greater slippage.

Order Type: Market orders are particularly susceptible to slippage because they are filled at the best available price once they reach the market. In contrast, limit orders are set to execute only at a specified price or better, which can prevent slippage but may result in missed opportunities if the market doesn’t hit that price.

Broker/Exchange Role: The efficiency of brokers or exchanges in processing trades also impacts slippage. Delays in execution can increase the chance of slippage occurring.

Impact on Traders: Costs and Risks

Slippage places traders on a financial seesaw; it can both erode profits by increasing entry costs or reduce losses by lowering exit costs unexpectedly. On one end, when you’re entering a position and slippage works against you (negative slippage), it increases your entry cost which immediately sets you back further from your profit target. Conversely, positive slippage - though less common - could mean entering a position at a better rate than expected or exiting with less damage than anticipated.Prevention Strategies: Minimizing Slippage in Trades

Combatting slippage relies on smart planning and understanding market behavior:Right Time to Trade: Trading during peak volume periods can ensure more liquidity and potentially less volatility – reducing the chance for significant price changes while an order is being executed.

Using Limit Orders: By specifying the maximum acceptable purchase price or minimum acceptable sell price, traders can shield themselves against negative slippage.

Improving Execution Speed: Utilizing platforms with faster execution speeds minimizes the delay between order placement and fulfillment.

Though an unwelcome guest in trading scenarios, acknowledging slippage as an intrinsic element of market dynamics is essential. Traders must adapt by deploying informed strategies designed to mitigate its influence. Understanding its causes enables preemptive action while knowledgeably tweaking one’s approach based on current market conditions optimizes trade outcomes. By embracing these strategies within their practice, traders can navigate around this pitfall for improved performance - turning what was once seen as an adversary into just another calculated variable within their control.

trading # slippage # marketconditions # impact # preventionstrategies

trading # slippage # marketconditions # impact # preventionstrategies

Report

My comments